If all goes as planned, millions of Americans will soon be getting another stimulus payment. This time, it’s up to $1,400 for individuals, $2,800 for couples, and an additional $1,400 for dependents.

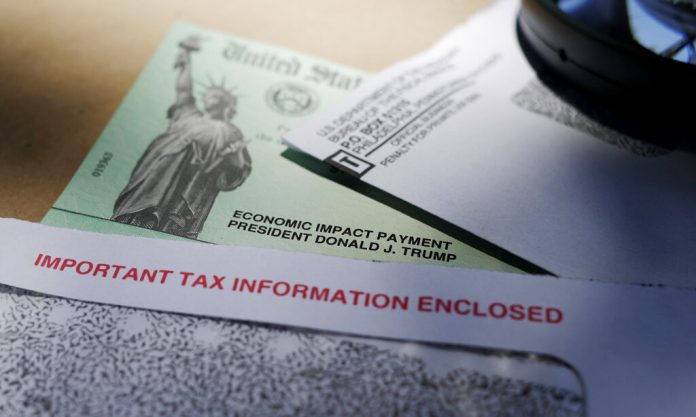

The payments under the American Rescue Plan, which was adopted by the Senate on Saturday, are the third and so far the largest of the payments sent to Americans under coronavirus relief packages over the last year.

The payments will be distributed by the IRS. By now, the agency has experience in delivering the money quickly to eligible individuals and families.

But, no doubt, there will be some glitches, which is to be expected given the number of payments that could be sent in a matter of days.

The IRS has said it will issue information and details on the distribution of this third payment once the bill is passed by Congress and signed into law by President Biden. The House is expected to vote on the measure Tuesday, and Biden has said he will move swiftly to distribute the relief.

Based on the last two rounds of stimulus payments, here are answers to some common questions.

Will I have to do anything to get a stimulus payment?

At this point, the IRS will probably issue advance payments either based on your 2019 federal return or your 2020 return if you have filed one already.

If your income was too high for a payment based on your adjusted gross income for 2019 but you think you may be eligible based on your circumstances from last year, you should file your tax return as soon as you can.

For example, you may have lost your job last year. You may have had a child, which would make you eligible for a dependent payment of $1,400.

However, the IRS has cautioned that you shouldn’t file before you have all the information you need to submit an accurate return.

“We are building a number of contingencies related to any new legislation that would come out,” Ken Corbin, the IRS’s wage and investment commissioner and its new chief taxpayer experience officer, said during a news conference last month. “And one of the things that we are, of course, thinking through is what would that experience be for those taxpayers who might be entitled to more based on a tax year 2020 filing? But our advice would be to file an accurate return. If you don’t have all the information or you’re still waiting on some additional documentation, don’t rush to file that return. File it accurately, and that will make the experience better for the taxpayer.”

To claim your stimulus payments from the previous two rounds of relief, look for Line 30 on your tax return.

How soon will I get a stimulus payment?

Just two days after the second stimulus package was signed into law on Dec. 27, providing $600 payments to eligible Americans, the IRS began making direct deposits to eligible recipients’ bank accounts. A day after that, on Dec. 30, the agency said it began mailing paper checks.

A similar timeline could also hold true for this third round of payments.

How much do I have to earn to qualify for a payment?

You don’t have to have income to qualify for a stimulus payment. But there are income caps.

For the third round of payments, eligible individuals with an adjusted gross income (AGI) of $75,000 or less are entitled to the full $1,400. The ceiling is $112,500 for individuals filing as head of household and $150,000 for couples filing jointly. Eligible taxpayers will also receive an additional $1,400 for each dependent child.

How much do I have to earn before I’m ineligible for a stimulus payment?

It’s all about your AGI, which is your gross income minus certain adjustments.

This time around, the AGI phaseout happens sooner than in the previous stimulus packages. So you may have received money in the first and second round but won’t get a check in this latest stimulus package.

If you file as an individual and your adjusted gross income is more than $80,000, you aren’t entitled to a stimulus check. The cutoff is $120,000 for individuals filing as head of household. Couples earning more than $160,000 will phase out of a payment.

Don’t assume you won’t qualify. If you aren’t sure of your AGI, you’ll find it on Line 11 on Form 1040 and 1040-SR for the 2020 tax year. It’s on Line 8b on your 2019 federal tax return.

How will I get my money?

In previous rounds, the IRS issued payments either by direct deposit, a mailed check or prepaid debit card.

However, just because you got a direct deposit previously doesn’t mean the payment will be delivered the same way for this third round. You may get a check. It’s also possible the IRS may send payments on a prepaid debit card.