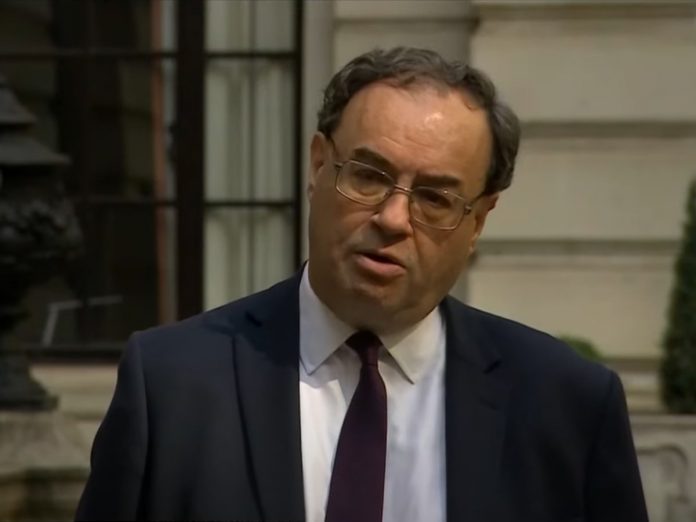

Bank of England Governor Bailey has increased his criticism of the EU stance towards financial services access and expectations of UK exclusion will intensify.

Bailey has insisted that standards in the City will be maintained, but pressure for new business areas will intensify. The degree of success in adapting to the new environment will have significant implications for long-term trends in the Pound Sterling.

The British Pound is seen slightly on the back foot against the Euro and US Dollar on Thursday.

Bailey criticises EU isolationist stance

In his Mansion House speech on Wednesday, Bank of England Governor reiterated his criticism of the EU over the issue of UK access to EU financial services.

In particular, he criticised strongly the EU insistence on setting rules for the City of London.

“I’m afraid a world in which the EU dictates and determines which rules and standards we have in the UK isn’t going to work.”

In this context, Bailey added that it would be a mistake for the EU to pursue an isolationist stance.

“Is the EU going to cut the UK off from itself? There are signs of an intention to do so at the moment but I think that would be a mistake,” he added.

best exchange rates todayThe comments will reinforce concerns that the UK will be shut-out of the EU market.

UK and EU counterparts are negotiating the terms of a memorandum of understanding over access for City institutions to European financial markets, aiming to reach agreement by the end of March.

Bailey added; “We have an opportunity to move forward and rebuild our economies, post-COVID, supported by our financial systems. Now is not the time to have a regional argument.”

Bailey insists standards will be maintained…

Instead, Bailey pushed for the adoption of global co-operation and regulation.

“We have to state the argument for global standards and markets and openness and if we all sign up to that then there’s no need to go in that direction.”

The EU has expressed concerns that the UK would look to lower standards in order to increase market share and this argument was again rejected by the BoE Governor.

“Let me be clear, none of this means that the UK should or will create a low-regulation, high-risk, anything-goes financial centre and system.”

He added; “We have an overwhelming body of evidence that such an approach is not in our own interests, let alone anyone else’s.”

Bailey remained optimistic over the long-term outlook, insisting that the City of London would; “undoubtedly continue as one of the world’s leading if not the leading financial centre”.

…but pressure for change will intensify

Former Newton Investment Management Chief executive Dame Helena Morrissey, stated that many economic predictions of the City post-Brexit assumed dealmakers and business would “stay static” without EU access.

“Of course that’s not how the City operates! It has been innovative and never relied upon the EU for that innovation and its global perspective”.

“If we don’t get a deal we will see regulatory divergence (the Bank of England has already made that clear) and there will be great opportunities from that.”

The City of London Corporation, which administers the capital’s financial district, said the tax contribution of £75.6 billion in fiscal 2019/20 was marginally higher than the previous year, but PwC consultants warned that there could be a decline of over £4bn for the current fiscal year.

There will inevitably be a short-term impact from coronavirus with hopes for recovery next year, but pressure to recoup revenue will increase.

“City of London Corporation political leader Catherine McGuinness stated “the future is uncertain, and we do not yet know the long-term impacts of the pandemic, Brexit and changes in ways of working.”